Remove Taxes that Incentivize Water Waste

Although most Utahns embrace free-market principles, Utah’s practice of collecting property taxes to lower the price of water incentivizes users to waste water.

Utah’s wasteful tax based system. Why is Utah America’s #1, highest water user? Utah is unique in collecting property taxes from homeowners and businesses to lower the price of water. These taxes are why Utah has America’s cheapest water rates—and why Utah is the nation’s most wasteful water user. If you own a car, pay for housing, or own a business you’re paying taxes for others to waste water.

Water taxes create runaway government spending. Like any government-funded subsidy, lowering the price of a commodity increases consumption—which is exactly what Utah’s water project salesmen want. Utah’s high water use is used to create the illusion of a future water shortage and justify spending even more tax dollars on expensive water projects (like the $3 billion Bear River Development).

It is perplexing that a state claiming to support free-market principles would invest itself in a tax-based water system that encourages waste. Wouldn’t it make more sense to subsidize conservation measures and let individual users and the free market determine the price of water?

If we phased out these water taxes it would be as if someone put $200 on your kitchen table and let you choose between putting it in your wallet, or outside in your garden hose.

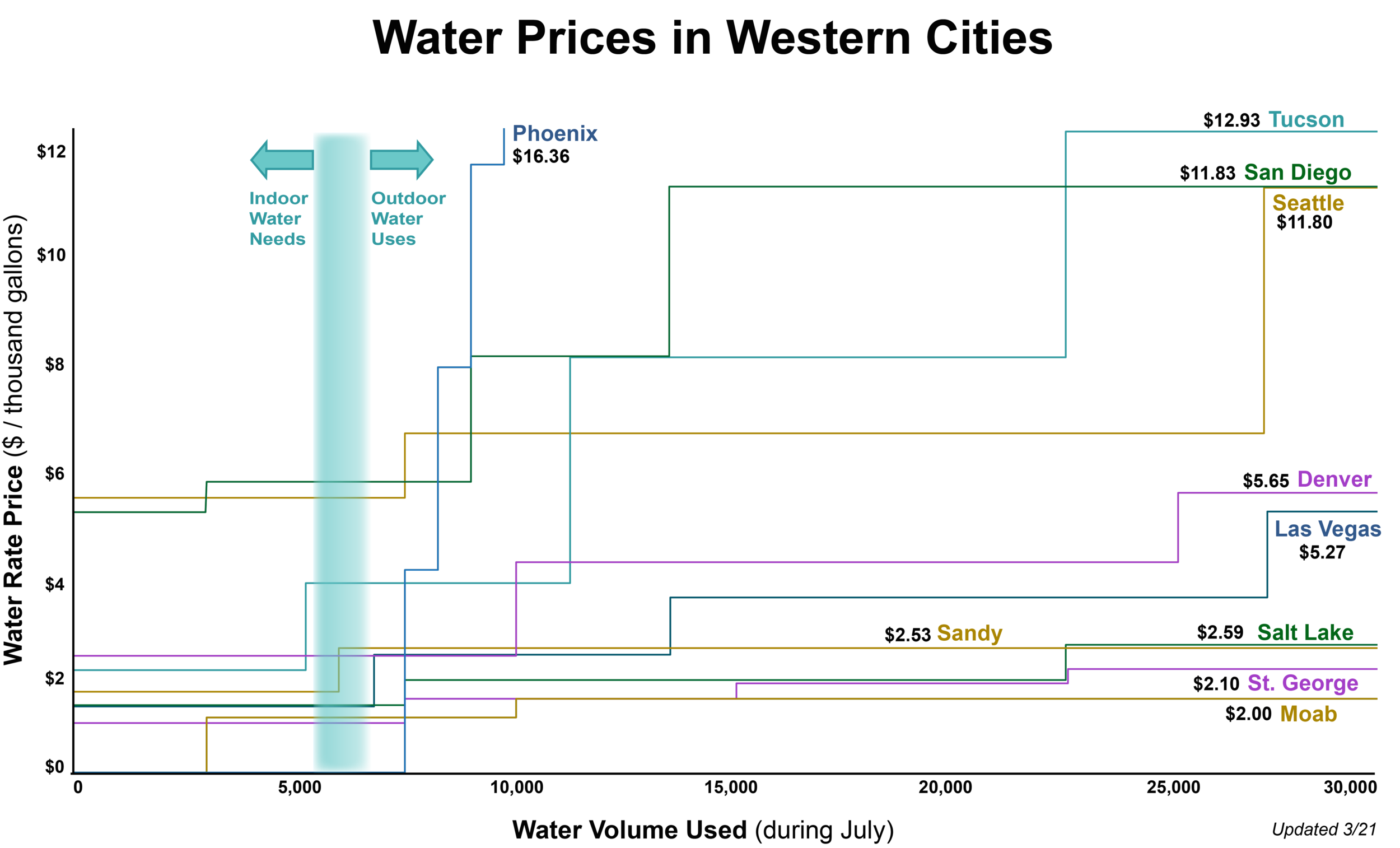

Paying for what you actually use. Many fiscally-conservative Utahns are surprised to learn that they pay two, three or even four different hidden water taxes on their homes or businesses, while large government landowners that often use large amounts of water pay no taxes. This isn’t the case in other states, where 78% of water suppliers don’t collect property taxes, instead pricing water at its real market value and charging only for what was used.

An unfair burden on low-income families. At first glance, low water rates seem like a good deal for those in poverty, until you look at the burden of higher taxes they are forced to pay. These taxes make up a much larger percentage of the total income of low-income families, in part because they are paying for the water use of higher-income residents, governments and large institutions. Statistically, low-income families use just a small fraction of the water used by large landowners, yet they still pay for it in higher taxes.

A free market system would save water. An economic model created at the University of Utah calculated that Utah would save billions of gallons of water every year while simultaneously reducing the tax burden on residents and businesses. Reducing water waste would also delay or eliminate the need for billions of dollars in taxpayer spending and debt on unnecessary water projects.

Indoor water rates would not need to be raised. The lost revenue from phasing out property taxes could be recovered by utilizing a tiered water rate structure to shift the cost to outdoor use (where the majority of municipal water is used). This structure would lower the burden on individuals by simply charging larger water users the actual price of the water they use, thereby rewarding conscientious water users.

Learn more:

Read more on these wasteful water taxes in our How to Break Utah’s Water Waste Cycle report

See how the rest of the West funds water in our Mirage in the Desert report